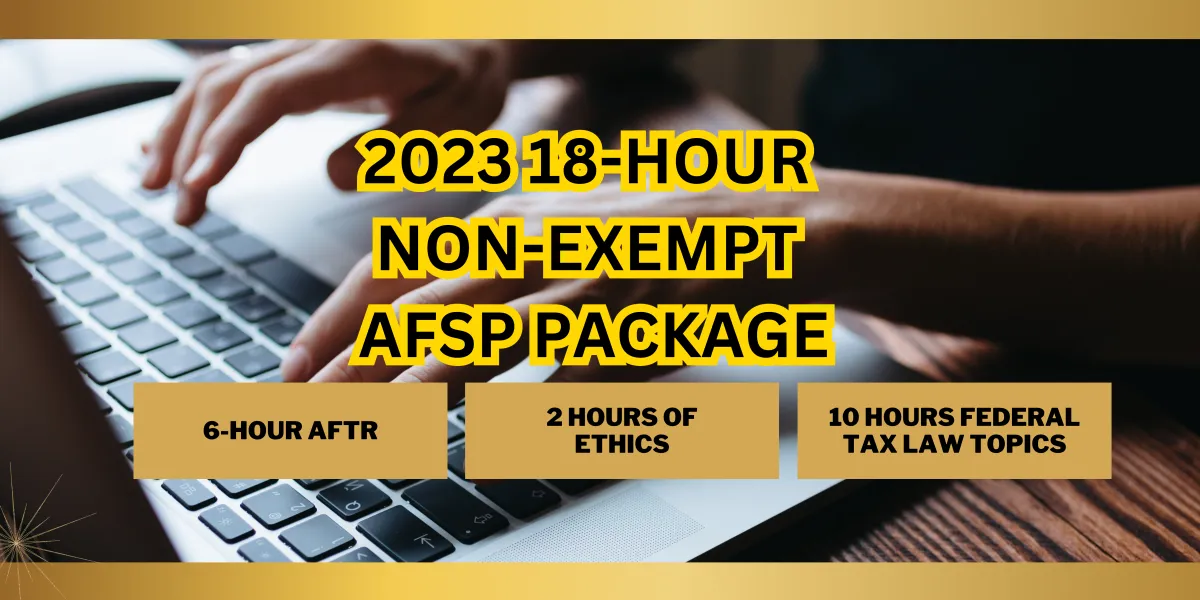

2023 AFSP 1040 - 18 Hours Basics CE Package

Package Details

$94.95

Access Period:

4 months

Form 1040 is one of the official forms used by U.S. taxpayers every year to file an annual income tax return. While the latest version of the form is intended to make it easier for taxpayers and tax preparers to file, there are still a few things that can be missed. It is important for tax preparers to not only know the form but also know the various schedules that may need to filled out with it for more complicated tax situations.

Choose this package of courses for an in-depth overview of Form 1040 and the 1040 Schedules. Main learning concepts include:

-new tax law and recent updates for current filing season

-identify those persons who must file an individual federal income tax return and determine the appropriate filing status

-get to know the credit section of Form 1040 and the more common credits you might see in your tax practice

Courses included will meet all the CE requirements of the IRS Non-Exempt Preparer Annual Filing Season Program (AFSP) – Record of Completion.

AFTR course must be completed by 12/31/2023 and only 4 exam attempts will be allowed for completion.

Please note: Upon completion of the CE courses, you will also need to consent to specific practice obligations outlined in Subpart B and section 10.51 of Treasury Department Circular No. 230 to complete the program requirements for the AFSP-ROC. This information can also be found in your secure email account once you log into your PTIN account. Contact the IRS for any questions regarding the AFSP Record of Completion.

Package Includes:

2023 Annual Federal Tax Refresher

Circular 230 in Action

Filing Status and Dependents

Form 1040 Part 1: Filing Status, Exemptions and Income

Form 1040 Part 4: Adjustments, Deductions, Tax, and Credits